RAGA Joins the Anti-ESG Push

We've talked before on the podcast about the growing backlash against taking environmental, social, and governance or E S G factors into consideration when it comes to investing. The watchdog group Documented first revealed last year that state treasurers were getting in on the action, kicking "woke" investment firms like BlackRock out of their states.

Back then, I wondered when the attorneys general would show up to join the fray, and now sure enough, they are here. The Republican Attorneys General Association, RAGA, our old favorite, has come to play in the anti-ESG space. But first, a quick reminder, why all this upset about ESG all of a sudden in the first place?

Good question. For a really long time, oil companies actually kind of loved ESG. It was all very loose and self-reported, and it gave them a way to unlock so-called "green capital."

But in 2021, the Securities and Exchange Commission, the SEC, looked around and went, huh? There are all these different ESG ratings, and some of them seem a little scammy, and no one knows what these disclosures even really mean. These are the kinds of things that it's our job to clean up. So we are going to provide formal guidance on climate risk disclosure. And that is when you start to see corporate interests, fossil fuel companies and right wing politicians lose their minds over ESG and start sqawking about "woke capital,"... because all of a sudden they couldn't just write whatever they wanted to in a report and call it ESG.

They might have to actually disclose what their real climate risks are. And that is the big problem, especially for polluting industries.

"I think that a lot of this, both the legislative side, this legal strategy, the strategy of using state treasurers to pressure asset managers and to attack climate disclosure, all of this is really mostly aimed at SEC Scope-3 emissions disclosure requirements coming, you know, supposedly coming soon in the next couple of months even," Jesse Coleman, with Documented, told me.

Let's pause here a minute to define Scope 3 emissions. Scope 3 emissions are a company's supply chain emissions. So they include everything that goes into making it and using it, so upstream and downstream. That's a big deal for all sorts of polluting industries; the oil and gas folks would rather keep things focused upstream, where they can talk about how they're reducing the "carbon intensity" of pumping oil, while big ag likes to keep things focused downstream where they can point people's attention toward sustainable packaging or reduced shipping emissions. None of these industries want the SEC looking at the part of their supply chain hiding 80 to 90 percent of their emissions.

"Yeah. It's a really big deal, you know?" Coleman said. "Whereas ESG, having non-standardized ESG disclosure is no big deal to a major company. The SEC coming and saying how much carbon emissions are you really responsible for, not just, you know, what you're claiming you're responsible for, but if you're an oil company, for example, how much carbon are you actually putting in the atmosphere from everything that you've gotten from underground? What is your real impact? And that is a really big deal. It's probably one of the biggest climate policy issues in play right now. So, in my opinion, a lot of this anti E S G stuff, which doesn't make a lot of sense on its face. You know, these state bills that have passed in some states and been introduced in a ton of states, the actual thing that those bills are gonna do, they're not gonna have a really big impact. And sort of this antitrust stuff is very similar in the sense that, you know, the claims are kind of weak and it's hard to say exactly what the impact is gonna be specifically, but at the same time it's building up all of this pressure, and it's building up all of this political inertia that is all aimed at opposing disclosing climate emissions, and that's what this SEC rule would do when it comes out is that it would, it would require publicly traded companies to disclose those emissions. So, you know, in my opinion, that's the real goal, is to keep that from happening."

Ah yes, the "antitrust stuff." That would be the legal strategy of the anti-ESG campaign, which is where the Republican Attorney's General Association comes into the picture. Back in June, 2021, a guy named Jason Isaac, who spearheads the Texas Public Policy Foundation's work on energy, went to a meeting of the American Legislative Exchange Council, went to a meeting of the American Legislative Exchange Council (ALEC) with an idea for a legal strategy that he thought could take ESG down. Documented shared audio from that meeting with us:

Jason Isaac: Yeah, so earlier, a couple months ago, our state affairs. Committee voted nine to nothing. So broad bipartisan support. Every single member voted in support to give, uh, the committee subpoena authority. So they have sent out letters to these financial institutions to get some paper documents to find out where this collusion is happening. We anticipate truckloads of documents being delivered, and so we look forward at the Texas Public Policy Foundation to going through those meticulously. Because we believe that there is...we actually partner with Boyden Gray Associates Law Firm out of Washington DC...corporate collusion liability risk for the ESG agenda to charge higher fees and rig the market. We believe that there's anti-trust violations. This is really kind of geared towards our attorneys general to lay the foundation for antitrust violations on this corporate collusion. Find out the connections with the Glasgow Financial Alliance for net zero, which has over a, I think a hundred trillion dollars under managed assets in their, in their cartel that's colluding for this two degrees, this net zero, this Paris Accord. It's all rooted in decarbonization, which is net zero. So I hope our committee gets a ton of paper back from these large financial institutions and they get hammered in the courts, and our attorneys general around the country file antitrust violations.

So yeah, cartels, colluding for decarbonization. What the hell is he talking about here? We're gonna try to answer that question.

If you prefer an audio version of this story, you can listen to it wherever you get your podcasts, OR upgrade to a paid subscription via the button below and get an ad-free episode delivered straight to your inbox, and accessible via any web browser.

So after COP26 in Glasgow, insurers and asset managers both formed groups focused on ESG and its role in meeting various countries' net-zero commitments. In both cases, these firms were saying, look, all sorts of environmental and social factors can impact our bottom line, and we would like to know what those risks might be. So we can factor that into our decision making around what to insure and what to invest in.

But according to Isaac, these firms talking to each other, issuing joint statements about what kind of information they'd like to see from companies? That's colluding to rig the market. In the wake of that 2021 ALEC meeting Isaac was presenting at, not only did Texas continue with the investigation he mentioned, but Arizona Attorney General Mark Brnovich opened an investigation into ESG investing.

And RAGA coordinated a letter to various asset managers and politicians with more than a dozen attorneys general signed on, stating their concern that ESG investing might actually be an antitrust violation.

"We started to see, you know, some of the bright lights of the Republican Attorney's General Association file various kinds of legal attacks on ESG issues," Coleman said. "Whether that's, you know, going directly after asset managers and asking them questions about their net zero commitments, or that's, you know, going directly after ratings agencies and, you know, saying that you're boycotting fossil fuels."

And they seem to have coalesced around this idea of painting ESG as some sort of corporate collusion, building an antitrust case.

"The allegation is that a lot of large asset managers get together in a shadowy cabal and they plan to collude to reduce carbon emissions," Coleman explained. "The reason that these groups are alleging antitrust violations is that antitrust violations are very scary to companies. If a jury finds you guilty of an antitrust violation, it's very expensive and it's a pretty hard bar to meet. And most experts are saying that the antitrust allegations that are coming from, these people that are opposing climate policy, you know, they probably don't have a leg to stand on, but, a lot like SLAPP suits and other kinds of legal tools that are used to silence people, just defending against an antitrust allegation is very, very expensive. So, you know, you see companies really backing away from participation in these kinds of global groups that are trying to address climate emissions, and trying to address, investment in the fossil fuel industry by large asset managers."

In 2022, ALEC once again held a meeting with a session on how to handle ESG at the state level, and again, the antitrust strategy was front and center. This time, Isaac was in the room cheering on new proponents of the strategy, including Will Hild with Consumers Research, which is funded by former Federalist Society President Leonard Leo; Paul Watkins, who used to work in the Arizona Attorney General's office and now runs an outfit called Fusion Law Advising on these sorts of strategies Andy Puzder, former CEO of the food conglomerate that is home to Wendy's and Hardee's and Catherine Gonsales with the Heritage Foundation. Puzder kicked things off by comparing ESG investors to, not kidding here, the Nazis

"I want to tell you, ESG investing is socialism in sheep's clothing," Puzder said. "And this is, this is the challenge of your generation. My father's Generation's challenge was the Nazis, who by the way, were of course, uh, very proud socialists. The challenge of my generation was the communists who were of course, very committed socialists. The challenge of your generation is ESG investing, and it's more insidious than communism or the Nazis. It's more insidious, it's more devious. You almost have to respect how comprehensive this horrible thing they're doing is. So, ESG, you know, environmental, social, and governance. Like how bad could that be? Right? It sounds so innocuous, but it's a ruse. It's a ruse to conceal the fact that it's a direct threat to our founding principles. It's a threat through our democracy.

Hild and Watkins kept it focused on the litigation strategy.

"This consortium, is these companies coordinating their activities," Hild said. "They get in rooms and they talk about how they're gonna set a policy across the market. Now, it's been a while since I was in law school, but when I was there, that was antitrust 1 0 1."

"And then that's why you see US senators saying this is potentially criminal antitrust liability," Watkins added. "You see AGs saying that they're going to investigate, as an example."

I have yet to speak with a single legal expert who thinks that this strategy could actually win in court. But like Coleman said, that is not necessarily the point.

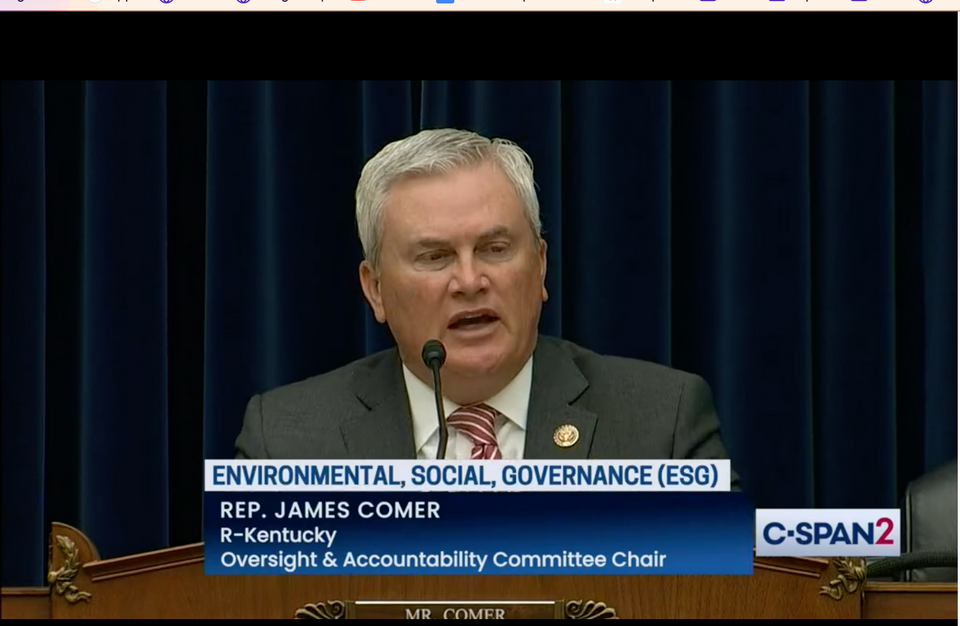

It's already having a chilling effect on investment firms and insurance companies in these net zero groups. And now that Republicans have control of the House, it's the focus of a series of Oversight Committee hearings too. The first one happened back in May, and featured the Attorneys General of Utah and Alabama as witnesses.

"Ever since the signing of the Paris Agreement, there's been an open conspiracy to bypass Congress using the power of horizontal agreements by key players in our financial system," Utah AG Sean Reyes testified. "Some of these groups are Climate Action 100, the Glasgow Alliance for Net Zero, which include the largest asset managers, banks, and insurance companies globally. These horizontal organizations seek to use their collective market power over tens of trillions in assets to force burdensome changes on American companies."

The Democrats witness during this hearing, Illinois State Treasurer Michael Frericks gave a great and completely non-climate-related example of where ESG can safeguard profits.

"The more data we as investors have, the better informed our decisions are when selecting investments over the long term," Frericks said. "ESG is about looking at a wider range of risks and value opportunities that have, that can have a material financial impact on investment performance. For example, if you're investing in a pharmaceutical company, it's thinking about whether that company has exposure to massive lawsuits because of its role in the opioid epidemic. Our approach is to integrate material ESG factors into investment decisions along with many other considerations. We are not ignoring traditional financial factors like profitability and credit worthiness. We are integrating more data into our decisions to give us a better idea of risk and growth prospects."

Frericks also pointed out that limiting the information investors can get about the companies they're investing in is the exact opposite of a free market idea.

"This pushback is anti-free market, and anti investor," he said. "It is misleading and it is harmful. It harms retirement savers, pensioners, working people, businesses, and it harms America. This coordinated campaign is focused on ESG investing. Most people don't know what ESG is. ESG is data. ESG is simply additional information that investment professionals use to assess risk and return prospects."

"It is about value, not about values," Frericks added. "In order to maximize returns, an investor must be able to manage and mitigate risk. The more data we as investors have, the better informed our decisions are when selecting investments over the long term. ESG is about looking at a wider range of risks and value opportunities that could have a material financial impact on investment performance."

Earlier this month, the House Oversight Committee held its second hearing on this subject, calling on none other than Jason Isaac himself to testify

"I'm Jason Isaac. I'm the director of Life:Powered, a national Initiative of the Texas Public Policy Foundation to raise America's Energy IQ. And I live a high carbon lifestyle and I think the rest of the world should too," Isaac said. "I refer to the ESG agenda as the China ESG agenda. It does very little to help Americans. It does everything to help the Chinese Communist Party and again, making energy expensive, scarce, and government controlled. This body, the United States Congress has not ratified the Paris Treaty. It is not the law of the land here in the United States. But to force an American entrepreneur to admit that his company will comply with that is, is just mind blowing to me."

Whether the committee will hold a third hearing remains to be seen. I'm not sure the anti-ESG bench of "experts" rolls that deep. Plus, while these ideas might get folks at an ALEC meeting riled up, they're remarkably unpopular with American voters, including the majority of Republican voters.

New Mexico rep, Melanie Stansbury made that point at the June Oversigh Committee hearing.

"What I find particularly strange about this conversation is that over 63% of American voters actually oppose, directly oppose, any kind of government interference in investing strategies," Rep Stansbury said. "And the vast majority of Republicans oppose it as well. And you know, when you look at the bigger picture, when you look at what the American people are actually asking Congress to do, asking businesses in the private sector to do, almost 70% of Americans are in support of actions to address climate change, to transition to a clean energy economy."

Whether the SEC will be swayed by the antitrust argument remains to be seen.